Policy statement on Hybrid Mismatches updated; no longer double taxation in cost-plus situations | Meijburg & Co Tax & Legal

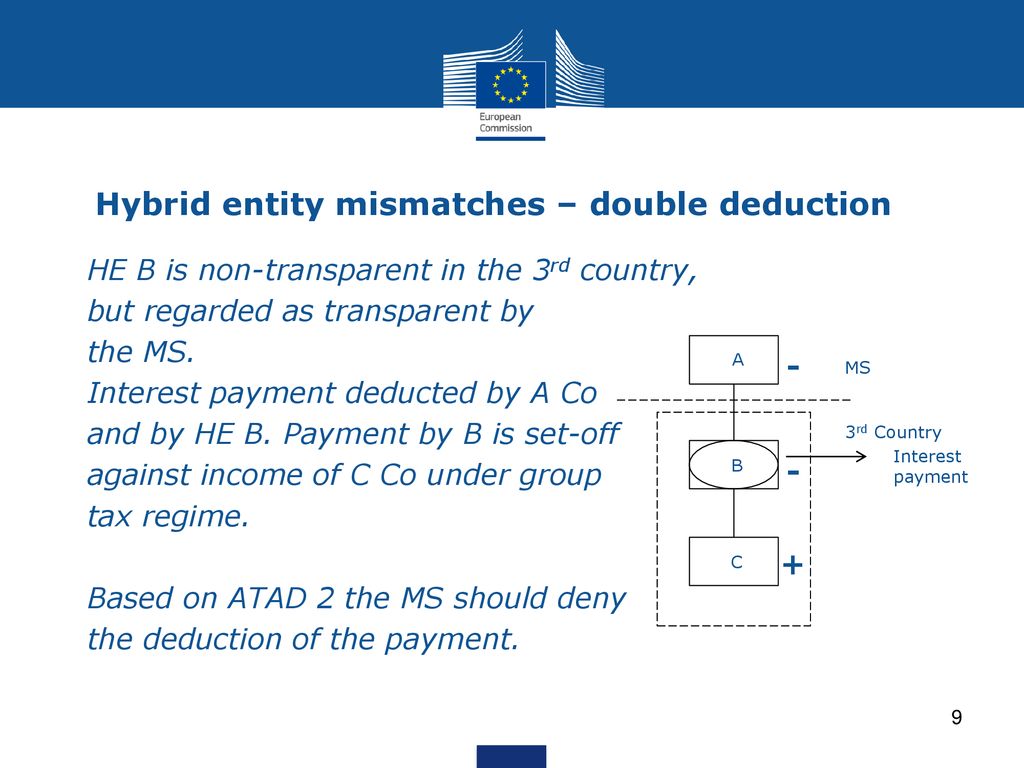

EU Tax & Customs 🇪🇺 on X: "Agreement on ATAD 2 - hybrid mismatches at today's #ECOFIN. Important step forward in tackling tax avoidance. https://t.co/gqAc61H8EU" / X

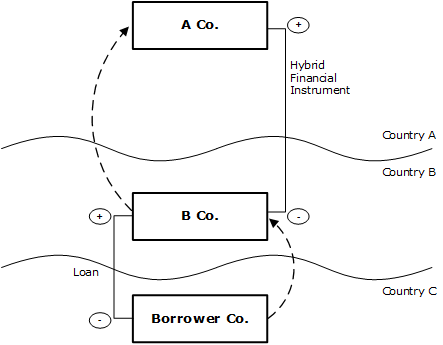

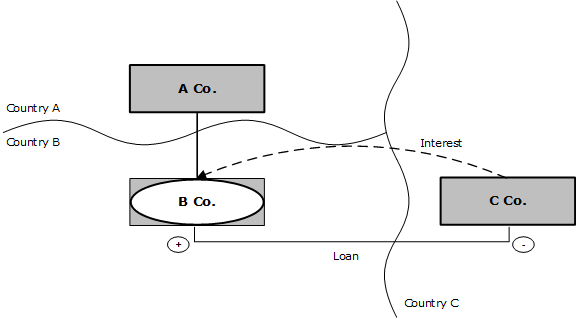

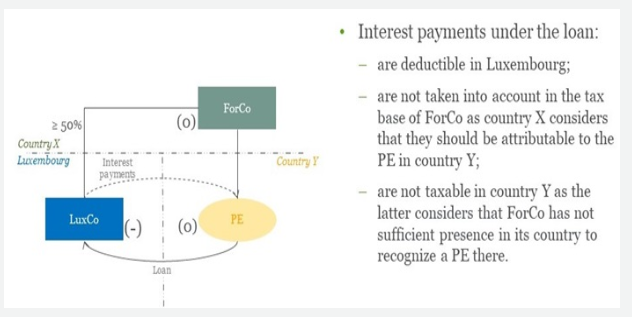

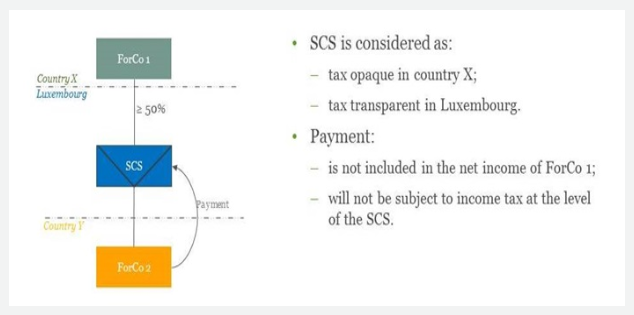

Luxembourg implements ATAD II (hybrid mismatch rules): What will be the impact on Alternative Investments (Private Equity, Real Estate, …)? | ATOZ Tax Advisers Luxembourg